- The Founder Games

- Posts

- Let's talk about valuation 🤑

Let's talk about valuation 🤑

the hidden intel #32 is in your inbox.

Welcome back to The Hidden Intel 💎 your backstage pass to everything unfolding behind the scenes of the reality show, the accelerator, and all the action in between.

Let’s begin 🎢

INTEL 🧠

Memento from Budapest

In Budapest, Petar and Sanja weren’t just attending NATPE.

They were working the room in true Founder Games style.

the shirt that got everyone talking and turning heads, which even the NATPE official account took this photo.

For context, NATPE is one of the biggest global markets and conferences for TV content buyers, distributors, and producers to discover new shows and formats.

Instead of blending into the sea of suits, they handed out business cards paired with condoms, stamped with The Founder Games brand and a cheeky hint that this show means serious business.

On top of that, Petar wore a bold T-shirt with a giant QR code, turning every hallway into a pitch opportunity.

It wasn’t just for laughs. It was a clever way to cut through the noise and start real conversations about selling The Founder Games as a TV format for international markets. People stopped, laughed, scanned, and most importantly, remembered.

It’s a solid lesson for anyone selling a format or anything that grabbing attention is often the first step toward closing a deal.

Big plans and news are coming, so make sure to stick around 🔥

LEVEL UP ⬆️

Startup valuation demystified ✔️

A huge thank you to Gogo Rafajlovski, COO of Networker and The Founder Games, for generously sharing these invaluable insights around startup valuation. His practical advice and regional perspective are a tremendous resource for founders navigating the funding landscape in the Balkans and beyond.

If you’re a startup founder in Southeast Europe (SEE) or the Balkans, chances are you’ve heard the word valuation thrown around in coffee chats, pitch events, and investor meetings. But what exactly is valuation, when does it happen, and how should you approach it, especially in those early days when your company is more idea than revenue?

Let’s break it down.

What is startup valuation?

At its core, valuation means assigning a monetary value to your startup i.e., how much your business is worth today. It’s not just a number; it influences how much equity you’ll have to give up to raise funds, your negotiating power, and even your future exit potential.

Think of valuation as the current snapshot - price tag on your company, but with a twist: it’s based less on what you’ve built so far and more on your future potential: your market, your team, your tech, and how big you might become.

Valuation can happen at several points:

👉 Before fundraising: You’ll need to value your startup before seeking investors, so you know how much equity to offer for the cash you’re raising.

👉 During term sheet negotiations: Investors will often propose a valuation when offering you a term sheet.

👉 During due diligence: It’s common for detailed valuation discussions to happen in the due diligence phase, once investors dig deeper into your numbers and business assumptions.

👉 When issuing employee stock options: You need a valuation to set option prices fairly.

👉 For M&A or exit planning: If you’re selling the business or going public.

First, let’s break down the pros and cons of valuation.

Good sides

✅ Provides clarity, as you’ll know how much equity you’re giving up for the money you raise.

✅ Attracts investors because A solid valuation shows you’ve done your homework and understand your business potential.

✅ Motivates your team because a good valuation makes employee stock options more attractive and meaningful.

Bad sides

❌ Highly subjective, especially at early stages, valuations can be driven more by negotiation than by data.

❌ Risk of overvaluation, as a sky-high valuation sounds great now, but can hurt later if growth stalls, leading to painful down rounds.

❌ Takes time because spending too long haggling over valuation can derail deals and distract you from building your business.

Valuation is always a negotiation

Here’s something every founder needs to know:

Valuation is ultimately a negotiation between you and the investor.

Sure, there are formulas and methods to help validate and ratify valuations, but at the end of the day, it comes down to human discussions and mutual belief in your company’s future.

Great founders see the valuation as a current asset. It can improve over time if your startup performs well and upgrades over time.

This is why valuation talks are about building trust as partners. If negotiations start going badly, meaning if an investor seems unreasonable, aggressive, or unwilling to listen, sometimes the best decision is to walk away.

Drivers of valuation

While valuation is a negotiation, investors usually anchor it around three key drivers:

Quality of the offer

How strong is your team?

How innovative is your product?

Do you have traction or unique IP?

Market heat

Is your sector “hot” right now?

Are investors competing for deals in your niche?

Your cash situation

How much runway do you have left?

Are you desperate for funding, or can you afford to wait for the right terms?

What are the expected incomes in near future?

General benchmarks for seed valuations in the Balkans

While numbers vary widely, here’s a rough guide for valuations in the SEE/Balkan region, particularly for companies raising seed capital:

€300K – €900K → For pre-revenue startups, including those graduating from accelerators.

€1M – €4M → For startups with €200K – €500K annual revenues.

€4M – €10M → For startups with ~€1M annual revenue, strong intellectual property (IP), or imminent major sales deals.

These benchmarks shift depending on:

Your sector (e.g., deep tech vs. consumer apps)

The country you’re based in

Local tax incentive schemes that can make investing more attractive

Balkan founders often face lower valuations than Western European peers because local markets and available capital are smaller, and there are fewer qualified investors. But global investors are increasingly taking notice of the region’s talent and cost advantages.

Now, the practical part 👇

How to value your pre-seed/seed startup?

Here are three common methods you can use and it’s wise to triangulate between them rather than relying on just one:

1) Reconstruction / Recreation Method

This method estimates the startup's value based on the cost to rebuild or replicate it from scratch. It adds up all tangible and intangible assets (like product development, IP, team, branding, etc.) to determine what it would cost a competitor to recreate the business.

Example:

A startup has:

Spent €80,000 developing its software,

€20,000 on branding and website,

€50,000 on hiring and training a team,

€10,000 on initial marketing.

Total recreation cost = €160,000. So, the estimated value using this method is €160,000.

2) Market Value Method

This method values the startup by comparing it to similar companies that have recently been sold or funded. It uses benchmarks like revenue multiples, user base, or industry-specific metrics to assess the fair market value.

Example:

You’re valuing a SaaS startup with €100,000 in annual recurring revenue (ARR). Similar SaaS startups in the same industry and growth stage are being valued at 5x ARR.

So, the estimated value = 5 × €100,000 = €500,000.

3) Future Value Method

Projects the startup’s future earnings and discounts them to today’s value using a risk-adjusted rate.

Example:

A fast-scaling health-tech startup projects the following:

In 5 years, it expects €15 million in EBITDA (profit).

You apply a 25% discount rate to account for risk and uncertainty.

You expect the value today to reflect what that future €15M is worth in today's terms.

However, investors often apply a multiple to the projected exit value.

Let’s say in 5 years, the company could exit at a 10x EBITDA multiple, so:

Future Valuation = €15M × 10 = €150M

Present Value = €150M ÷ (1.25)^5 ≈ €49.2M

Estimated current startup valuation: ~€49.2 million.

One final and critical piece of advice:

Don’t fixate solely on valuation. Always look at the full investment terms.

A high valuation might come with harsh liquidation preferences, board control, or other terms that could hurt you down the road. Conversely, a slightly lower valuation with founder-friendly terms might be the smarter long-term choice.

Valuation is important, but it’s only part of the bigger picture, because your valuation should only secure your next investment.

For SEE/Balkan founders, valuation can sometimes feel like a tightrope walk between local realities and global ambitions. Investors might propose lower numbers than you’d see in Western Europe. But solid fundamentals like a strong team, innovative product, and a clear plan for scaling can help you argue for a valuation that reflects your true potential.

Remember: valuation is both an art and a science. Know your worth, back it up with data, and don’t be afraid to walk away if the deal doesn’t feel right.

TL;DR Valuation is the meeting point between your vision and investors’ belief in your future. Approach it with preparation, realism, and the confidence that you’re building something valuable.

And remember – valuation only happens if there is a financial transaction from investor/s – anything else is just speculation.

👉 If you’d like help or personalized consultation around your own startup’s valuation, don’t hesitate to reach out to Gogo for guidance and support at [email protected]

THE STARTUP VAULT 🗃️

Founders take note:

Let AI show your users how to use the product with Pointer.

Clado is a deep research tool for people.

Streamline and optimize your prompts with PromptGround.

Hire elite tech talent while you sleep with Leah from OneProfile.

Hey ChatGPT 🤖

I’m having a persistent problem with [insert topic/problem here] despite having taken all the necessary countermeasures I could think of. Ask me enough questions about the problem to find a new approach.

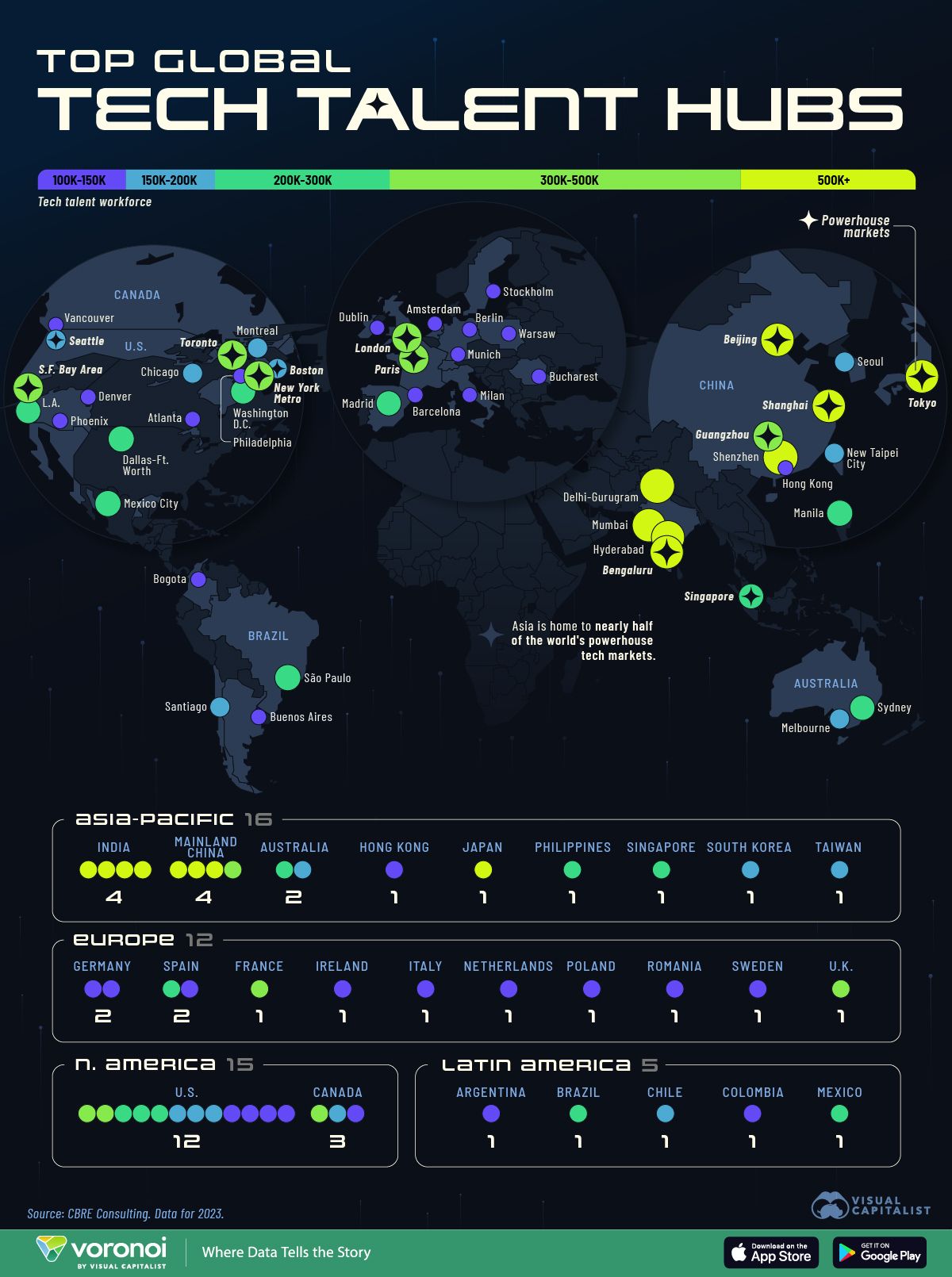

Visual of the week 🕵

BEST OF X 🐦

|

|

IN CASE YOU MISSED IT 🍿

Catch you next time for more updates, just like this one!

The team behind The Founder Games 👾

Was this email forwarded to you? Sign up here.